Our Firm

Our History

We pioneered the systematic use of financial and social data in the selection and evaluation of financial institutions when we created the first social and financial impact methodology, the Fully Adjusted Return (TM) index, in 1991.

MinorityBank.com was launched in 1998 as one of the first community investing websites

We provide research on women and minority-owned financial institutions: banks, thrifts, brokerage firms. We provide objective, independent information and analysis that can be used to select value adding women and minority-owned financial institutions for use in debt issues, stock offering, and stock buy back programs.

Specialization

The firm specializes in community development and socially responsible investing. The U.S. Department of the Treasury certified the firm as a Community Development Entity on August 29, 2003. We note that registration by any of these entities does not imply endorsement of the firm, Mr. Cunningham, his activities or his ratings.

Mission

Objectively furnish financial research and consulting services to institutions and others investing in minority markets. Client interests ALWAYS come first.

Performance

We believe it possible to create investments and portfolios that perform well financially and that address social concerns. We have uncovered many investment opportunities of this type.

achievements

Industry Firsts

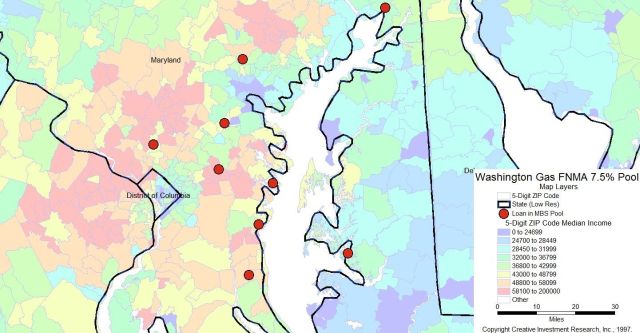

We developed the first targeted securitization, a FNMA MBS pool backed by loans from minority financial institutions. We designed and orginated the investment in 1992.

view our servicesHow we work

Our independence is critical. We have, over the years, observed a growing lack of objectivity in the financial markets. This lack of objectivity is less important during times of increasing asset values, but we believe independence and the objectivity it allows will become important when markets stumble.

Excellence

We created a community investment product that povided needed capital to community banks at th start of the financial crisis while providing a competative return to our client and allowing them to demonstrate their support for community financial institutions.

Community

We proposed, designed, and helped create a refinancing plan for victims of predatory lending in Minneapolis.

Integrity

On April 11, 2005, we testified on behalf of investors before Judge William H. Paley III in the US District Court for the Southern District of New York at a fairness hearing regarding the $1.4 billion dollar Global Research Analyst Settlement. No other investment advisor testified or provided comments at the hearing.

Trust

We developed a proposal for the first faith-based, World Bank-backed microcredit bond.

Our Selected Clients

Our clients include many of the Fortune 50.

Meet the Founder

We've enjoyed more years practicing than most like to admit.

Our experience and expertise cannot be duplicated. It is both broad and deep, given that we have been active in social investing for some time:

- Why New Orleans's Black Residents Are Still Underwater After Katrina. The New York Times. August 18, 2015.

- Making the Case for Crowdfunding with the Texas Association of African American Chambers of Commerce. The Dallas Weekly. August 18, 2015.

- The country's last black-owned banks are in a fight for their survival. The Washington Post. February 13, 2015.

- To Stop Next Crisis, Make S&P Own Up to Fraud in Settlement. The American Banker. February 9, 2015.

- 'Minority' Bank Designation Has Become Meaningless. The American Banker. July 1, 2013.

- Bank Nurtures Asian Roots. The Wall Street Journal. October 10, 2011.

- The First Bank Failure of 2008. US News and World Report. January 28, 2008

- Black Banks Gaining Strength, CNN, October 16, 1997.

- How Tiny MetroBank Wins Big by Catering To an Ethnic Marketplace. The Wall Street Journal. Monday, January 15, 1996. Page A1. New York, N.Y.

- Conversion Putting Carver Under Pressure to Perform. Crain's New York Business. Monday, September 26, 1994. Page 16.

- Minority-Owned Banks Seek Boosts From Big Rivals. The Wall Street Journal. Wednesday, December 16, 1992. Page C2.

- Television, newspaper and magazine articles.